Communicating the cost-of-living crisis: Love Energy Savings’ Rosie Macdonald

‘When a campaign takes root within the heart of the community, you are laying the foundations,’ believes Love Energy Savings’ senior digital PR strategist Rosie Macdonald.

In an effort to help those struggling in the Greater Manchester area during the cost-of-living crisis, the business utilities and price comparison retailer has teamed up with Lancashire-based brands to make a real difference. One initiative – distributing food to as many children in Bolton throughout the summer as possible while raising awareness of poverty in the area.

Tell us a bit about the initiatives you’re working on related to the cost-of-living crisis?

One of the campaigns we’ve launched is a programme to help provide one meal each working day to as many school children in Bolton during the summer holidays as possible.

More than a third of Bolton’s children are living in poverty and almost half (46%) of children living in the Bolton South East were living in poverty in 2020/21 – a figure which has only increased since the cost-of-living crisis.

Working with other Lancashire-local brands, like Robinsons, Dewlay and Fiddler’s Lancashire Crisps, we have put together donations to be circulated by Bolton Lads and Girls Club, a charity very dear to our hearts which helps provide activities, care and support to children and their families in the Greater-Manchester area. These meals are then delivered by a different Love Energy Savings volunteer each day and given to those who need it most.

We made sure to divide the donation requests into incredibly small quantities per brand, so that what we were asking for was so minute it would be difficult to refuse.

What have been the unique challenges you’ve faced with this work?

The logistical planning of getting all the food donations into the packed lunches and delivered by a LES volunteer each day to Bolton Lads and Girls Club for distribution was the initial hurdle, but the real challenge, funnily enough, was persuading local businesses that we weren’t trying to sell them anything.

It’s understandable why many would be wary of an ulterior motive, which is why we asked very small businesses for a significantly smaller quantity of items than a larger brand, which enabled them to get involved and still have their brand name attached to the project, should they wish. One local brand (Dewlay), actually donated double the amount of product that we asked for because of this.

What were your specific aims?

The aims of this campaign were two-fold. Firstly, and most importantly, we wanted to do something to alleviate the knock-on effects of the increased gas prices and the huge increases to the cost of living in our local community of Bolton.

The second purpose of the project was to aid in the regeneration of Bolton, something very close to our CEO Phil Foster’s heart. Phil has recently been a member on a Regenerating Bolton panel alongside other key pillars of the community and said: ‘To regenerate Bolton for a brighter future, we must invest in our youth to give them the best start we possibly can. We need to do this across everything from education and life skills all the way through to work.

‘However, children can’t concentrate when they’re starving and learning to skip meals is not one of the life lessons we need to be teaching them.

‘When the cost of living is so high that increasing numbers of parents aren’t able to provide the basics for their families, despite doing their absolute best, as brands that’s when we all have to sit up, take notice and do what we can to help.’

What have been your main successes?

As the campaign is still part-way through we’re hoping for significantly more successes to come. We hope that when the campaign reaches its conclusion, one of these will be the increased awareness drawn to the issue of child poverty in the Greater Manchester area. However, it is already evident that one of the biggest wins will be the relationships forged with fellow Lancashire brands.

Building those relationships and contacts will enable us to do campaigns on a larger scale in the future. This will ensure that when we’re setting the next campaign into motion, we can point to the success of the previous and embark on a bigger, bolder endeavour.

What advice would you offer to other organisations, initiatives and charities hoping to be heard by politicians and other change-makers on this issue?

Building a campaign that will reach the ears of politicians and enact change is no mean feat. Our advice would be to focus on the message and ensure that those your campaign is intended for remain front and centre.

Driving a thorough focus into the local area (if applicable) is the key starting point. When a campaign takes root within the heart of the community, you are laying the foundations.

Building strong foundations is incredibly key – from there you can diversify the angles you push, move onto national press and then become a part of the conversation on TV and media outlets. Lots of leg-work, a strong message and consistency are the most important ingredients for success.

How would you advise others with approaching the media to gain coverage on these issues?

Understanding the angles within your campaign is always step one. Once you understand the audience you can target accordingly. Different emails tailored for each angle and for each individual, coupled with follow-up phone calls is a winner.

Research is also vital. Knowing the right person to target, the right publication and timing are all factors that need to be juggled to achieve coverage success.

How do you ensure that your approach is sensitive to those particularly vulnerable during this crisis?

Common sense is key here, especially using language. Words like ‘impoverished’, ‘lower-class’, or any phrase that could bear negative connotations or pigeon-hole are an absolute no-go.

It’s also vital to treat the people you’re trying to help like people. It can be tempting to over-egg a story to play at the heartstrings of the public, but this has to be weighted with understanding that you aren’t just quoting statistics – these are real people’s lives.

When looking for case studies, forums and Facebook groups are a brilliant place to go to reach out, in addition to submitting case study ResponseSource Journalist Enquiry Service requests. Approach-wise, it’s always so important to be gentle and position your request as an opportunity for them to help share their story to shed a light on how bad the situation is for others – this goes hand in hand with acknowledgement. Understanding the difficulties and possible pride, shame or anguish that can be wrapped up in someone speaking to you is so important. Sensitivity will always get you further.

Which areas related to cost-of-living are underrepresented, in your opinion – what else should the media and politicians be paying more attention to/reporting on?

This winter we are likely to see a huge wave of people unable to afford to heat their homes. While this is being discussed, the alternatives – should immediate financial aid not be announced – are hardly touched on.

Public spaces and establishments open later are likely to see an influx of individuals looking to stay warm and save on energy costs. Are these places prepared? Are businesses and those with heated buildings doing enough to make sure they’re ready to invite people in?

Travel ingenuity also does not seem to be as widely covered as it ought to be. With petrol prices through the roof, what are individuals doing to save on costs? Have there been an increase in car-pooling schemes, or an increase in company cycle-to-work programmes? It could be argued that the possible benefits of increased fuel costs are not being addressed. Understandable, given how dire the situation is for so many who cannot travel in any other way – but what about those who can?

Have families hugely downsized the amount of cars they have? Are couples now sharing one car as opposed to two? Could this perhaps be a benefit to the planet and see a decrease in emissions?

Are there particular journalists/sectors of the media you’d like to highlight as doing a good job on reporting on the cost-of-living crisis?

There are so many to choose from. Miranda Bryant and Kirsty McEwan of The Guardian instantly come to mind. I do think a lot of top press are missing the tone, however. Money saving tips to save a few pence in a year seem to be rife, with the line between useful and absurdity often tipping to the wrong side of the balance.

How important is PR and comms for helping the public on this and making change to policy?

Incredibly important. PR is the man behind the curtain of the media – pushing for the right attention, ensuring journalists hear about the relevant news, the latest facts and figures. Without PR, a significant amount of information would never be seen by the general public.

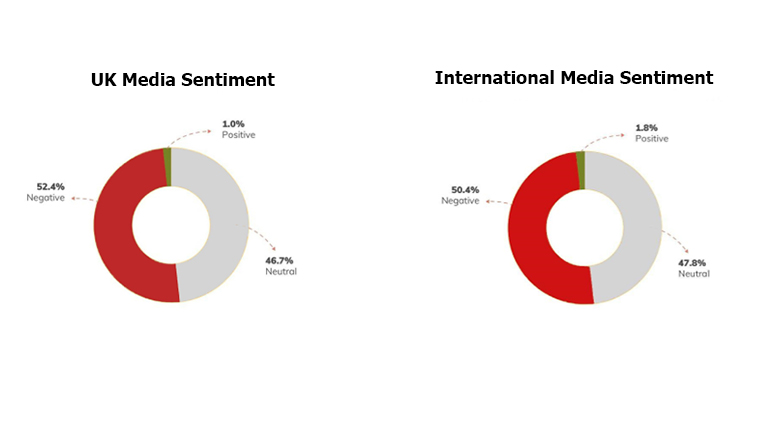

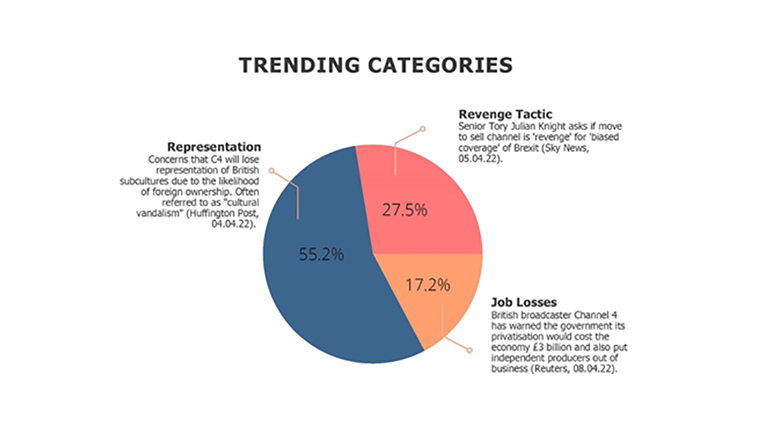

For more on the communicating during cost-of-living crisis, check out our report on how the top six UK supermarkets are communicating inflation as well as how to implement a PR strategy for a local charity.